Polymer Industry Updates: What's coming up in 2023...

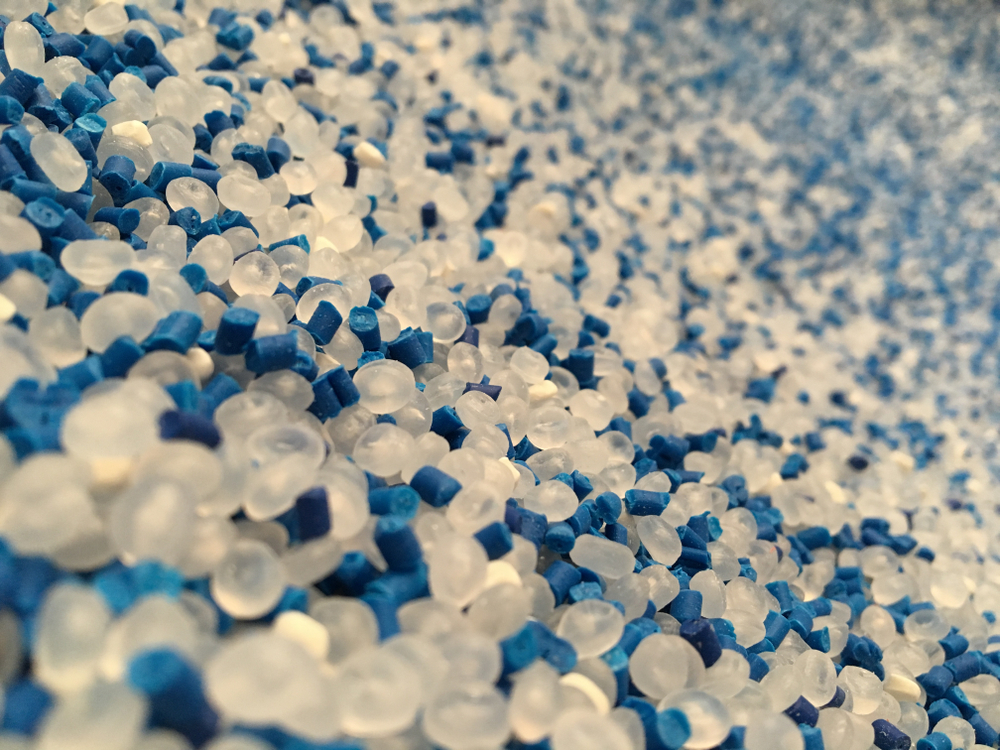

2023 is a critical year in the polymer industry at all levels. The global polymers market size is expected to grow finally after the economic recovery from the pandemic.

We have many reasons to be enthusiastic about the current year and how it will affect the sector. The Plentiful resin supply from China and USA (United States). Enhancing the supply chain and lowering energy costs should improve the availability and pricing of imported resins.

In this article, we will connect the dots to know the following:

♦ How leading petrochemical companies get ready for 2023?

♦ How the resin product prices change by the new factors in this dynamic market?

♦ What are the major Acquistions and mergers that happened in 2023?

♦ Dive into logistics& supply chain news.

♦ Quick Glimpse at Q1 profits of the leading companies.

♦ The future of the Packaging Industry in 2023.

Polymer Industry Updates

Plastic industry leaders predict that the demand for the plastic industry will be improved because of The probabilities Favour a soft landing in the economy over a recession.

First let us see how leading petrochemical companies get ready for the current year regarding resin production:

1- ExxonMobil will increase its spendings for 2023

ExxonMobil, the American International corporation, announced lately that it will lift its capital spending next year. The increase will be between $23 billion& $25 billion, which represents a 10% increase compared to last year.

When it comes to production plans, Exxon plans to build its 1st plastic waste facility in 2023 in Texas. This facility will produce volumes of recyclable circular polymers to meet the increasing demand.

Exxon demonstrated the facility capacity to process 50 tons per day.

2- Sabic plans to increase circular products production

Sabic, the leading petrochemical company, announces intentions to expand its capacity for circular polymers in 2023. The company has a circular innovations portfolio called “TRUCIRCLE”. This portfolio aims to give manufacturers an opportunity to use more sustainable polymers.

The company's first commercial plant is currently nearing completion in the Netherlands, and delivery of the first circular polymers are anticipated this year.

Sabic noted its massive progress in circular products. Certified circular PP from Sabic has been used to manufacture ice cream tubes for magnum Ice cream from Unilever’s ice cream brand.

“We plan to produce million metric tons of circular materials by 2030 to accelerate the circular carbon economy, we are committed to help our customers find more sustainable solutions” stated by SABIC CEO, Abdulrahman Al Fageeh.

3- Triparty deal between OQ, KPI & Sabic to minimize carbon footprint

OQ (Oman Oil Company), KPI (Kuwait Petroleum International) and SABIC (Saudi Arabian Petrochemical Company) signed a tri-party deal to develop a new project in Oman.

They have agreed to develop the mutually owned petrochemical complex in Duqm in the Omani special economic zone.

First, they will conduct research, then they will utilize their commercial and technical expertise to develop the project. They aim this project will be globally competitive and very profitable.

In this newly signed project, they aim to use the latest technology in the industry to minimize carbon footprint and commit high standards to protect the environment.

How the resin product prices change by the new factors in this dynamic market?

PE & PP huge scale oversupply: how does oversupply in global PE & PP affect prices?

Two specific indicators may contribute to the huge scale of oversupply in PE and PP in China and southeast Asia. The first is the traction among traders and producers after the LUNAR Lunar New Year holidays in January 2023.

The second is the end of the zero COVID policies. That’s why we should consider that global PE capacity will exceed demand in the period between 2022 and 2025.

Recent studies point to the demand averaging 24m tones during the next few years. To imagine the oversupply, you must know that between 2000 and 2021, the demand was an average of 10 million tonnes per year.

Regarding PP (polypropylene), the demand capacity in 2023–2025 is expected to exceed 21 million tonnes per year. In 2000- 2022, the average demand was 8m tones/year.

Now that many buyers are aware of the long-term slowdown, they are dealing from advantageous positions.

Economics experts expect that China’s demand for PE and PP will improve in the current period.

When it comes to pricing forecasting, we have to put price movements in parallel with feedstock cost movements. You also have to consider the feedstock costs and price differentials.

Peak bottled beverage season: How can we forecast PET demand in the USA?

Through the majority of 2023 Q1, US PET prices were stagnant, and the main reason was the low demand. The PET market has stayed quiet despite increasing demand.

Ahead of the second quarter of summer months, the PET market will witness increasing demand, especially for bottle grade.

Regarding PET pricing in the USA, there will be additional pressure because of the feedstock costs.

Force majeure declarations at 3 HDPE resin production plants: Can this affect HDPE supply?

As crude oil prices reached their lowest level since December 2021, PE & PP prices trended lower across the plastic exchange marketplace.

Till now, the flow of offers has stayed weak, and most PE grades are down a penny except HDPE and HMW.

HDPE interest was noticeably slower compared to the solid demand earlier in the month.

Processors sought to supplement supply in the wake of resin production issues and ongoing force majeure, according to the Plastics Exchange.

Now let's explore how prices change in the main regions:

In Europe, all polymer feedstock prices are rising due to the recent implementation of EU tariffs on products from Russian refineries. Also, the maintenance initiatives affecting European naphtha crackers. Besides the positive supply-demand balance, polymers producers are responding to supply shortages by raising margins.

Now, most producers in Europe are facing many challenges such as increased competitive penetration and low demand. They will try to increase prices.

When it comes to European converters, they will search for suppliers that are happy to make sales using existing materials in their warehouses.

Regarding the demand for polyolefins in Europe, prices have seen rebound. Producers are unable to pass the full increase.

From Europe to Latin America, most producers are waiting for spot export offerings. Asian traders will provide strong offers as they returned from Lunar New Year.

Regarding USA Region, Polypropylene and polyethylene prices will remain under pressure because of 2 main reasons:

- The Slower Economic Growth: It is expected to slow from 3.2% in 2022 to 2.7% in 2023. it is not inconceivable that the USA will face a recession in the 2nd or 3rd quarter of 2023.

- Resin Capacity Rising: According to ICIS, North America’s PP capacity will increase by almost 22%. North America’s PE capacity will expand by almost 17%.

In the Middle East, there are recent prices hikes because of two main reasons. The first one is the maintenance season across the region that affects the availability of materials.

Moreover, there has been an improvement in demand for plastic raw materials this year. This is reported by local sellers.

To View GAP Polymers' Most Recent Prices, click here

Plastic Industry in Numbers

.png)

Interest rates, coupled with high inflation, are affecting global demand. These factors affect the results of 2023's first quarter.

Numbers do not lie; let’s see how the leading companies performed:

Let’s see which company performs the best:

1- Aramco

Aramco, the Saudi Arabian Oil Co, has announced $31.88 in the first quarter of 2023.

The company aims to reduce operating costs to adapt to market requirements.

Worth mentioning that Aramco has surpassed Apple and Exxon to become the world's most profitable company in 2022. The company recorded $161.1 billion.

2- ExxonMobil

Exxon Mobil Corporation announced that it recorded 11.4 billion dollars for the first quarter of 2022.

This increase is considered a jump compared to last year when they recorded $5.5 billion.

The company aims to reduce greenhouse gas emissions by more than 10%.

3- Sabic

Sabic, the Saudi Industries Corp., has reported its revenue for the first quarter of 2023. It is considered a solid performance despite the current difficult market situation.

The revenue is surging to hit $10.6 billion. The strategic agreements have helped the company achieve this revenue.

To keep up with the ever-changing circumstances, the company aims to keep costs down and maintain a strong balance sheet.

4- Chevron

Chevron, the American multinational company, announced a first-quarter profit of $6.6 billion dollars.

It is considered an increase compared to $6.3 billion in the 2022 first quarter.

5- Dow

DOW recorded net sales of $6.1billion dollars in the first quarter of 2023. Dow sales are down 20% versus the year-ago period.

6- Borouge

Borouge, an Abu Dhabi-based polyolefins company, posted a $1.38 billion dollar net profit for the first quarter of 2023.

This profit represents a decrease in comparison with the fourth quarter of 2022.

7- LyondellBasell

LyondellBasell recorded a first-quarter net income of $474 million.

It is worth mentioning that the global olefin and polyolefin margins have increased during this quarter in the USA (United States).

To receive more updates, sign up here!

Latest Plastic Industry News

Acquisitions and mergers

When it comes to the latest news in the plastic industry, we must cover the major Acquistions and mergers that happened during the current year and affected the entire industry:

TotalEnergies has acquired Spain's Iber Resinas.:

TotalEnergies purchased Iber Resinas, a firm established in Spain that specializes in the mechanical recycling of plastics such as PP, PE, PS for sustainable uses.

TotalEnergies will grow its production of circular polymers in Europe, expand its portfolio of recycled goods, and improve its access to feedstock through Iber Resinas' supplier network.

Iber Resinas will benefit from operational synergies with TotalEnergies to produce high-quality goods and profit from the company's capacity to speed up growth.

Lyondell-Basell purchases Veolia's share in QCP (Quality Circular Polymers)

Lyondell-Basell is acquiring the shares in the plastic recycler Quality Circular Polymers (QCP) held by its joint venture partner Veolia Belgium

Quality Circular Polymers (QCP) is a LyondellBasell and Veolia joint venture that recycles domestic plastic trash into everyday items.

LyondellBasell will expand its sustainability approach to satisfy rising customer demand. It will grow its recycled manufacturing capacity to more than 2 million tones per year as a result of this move.

Aramco will increase its presence in China by acquiring a stake in Rongsheng

Saudi Aramco, the Saudi Arabian national petroleum and natural gas firm, will purchase a 10% share in Shenzhen-listed Rongsheng Petrochemical Co. Ltd. for RMB24.6 billion ($3.6 billion), according to ChemOrbis.

With the transaction, Aramco would supply Rongsheng affiliate Zhejiang Petroleum and Chemical Co. Ltd (ZPC) with 480,000 barrels of Arabian crude oil per day.

Subject to regulatory approvals, the acquisition is scheduled to be completed by the end of this year.

The statement came shortly after Huajin Aramco Petrochemical Company (HAPCO), an Aramco joint venture, announced plans to begin development of a massive integrated refinery and petrochemical complex in northeast China.

Shutdowns & Openings

Regarding the Shutdowns& Openings, here are the most important ones that took place in 2023:

Sinopec Qilu shuts down the No. 2 HDPE facility

Sinopec Qilu Petrochemicals has closed its No. 2 High density polyethylene (HDPE) facility.

The unit was recently taken off stream for maintenance. Further information on the duration of the shutdown could not be obtained.

The No.2 HDPE unit, located in Zibo, Shandong, China, has a production capacity of 70,000 mt/year.

Oriental Energy (Ningbo) activates a PP unit

Oriental Energy (Ningbo) has resumed its Zhejiang polypropylene (PP) factory.

Following a turnaround, the company resumed operations at the unit. On April 19, 2023, the unit was shut down for maintenance.

The PP unit, which is in Ningbo, Zhejiang, China, has a production capacity of 400,000 mt/year.

Saudi SABIC expects to complete the Dutch chemical recycling project in the fourth quarter

SABIC intends to complete its first chemical recycling plant in Europe in the fourth quarter.

It seeks more collaboration partners in Asia to promote wider acceptance of recovered plastics.

The factory will rely on mixed plastic waste as a feedstock source and will have a capacity of up to 20,000 tons per year.

Plastic is recovered from Malaysian rivers and recycled for use in premium noodles packaging.

Logistics News

1- A Sharp Decline in Freight Rates and Volumes Has Affected Maersk's Profits

Maersk suffered a decline in the first quarter of 2023, with earnings before taxes coming in at $4 billion, less than half of the $9.1 billion earned in the fourth quarter of 2022.

This significant decline in first-quarter net profit as inventory corrections in Western economies reduced shipping demand, lowering freight rates and volumes.

Maersk stated that it is "difficult to predict" when volumes will improve. It remained optimistic, though, that volumes will "gradually rise up" in the second half of 2023.

2- Sudan Recent Developments: The effect on shipping

According to Maersk, the current political crisis in Sudan has caused substantial disruption and anxiety for shipping customers.

- Depending on the latest updates, it’s all about the temporary curfew that has been enforced In Port Sudan.

- The port of Port Sudan is still open for business. Stevedores and other workers who must operate in the port during curfew hours must obtain special permits.

- Cargo loading and unloading operations, including the oil port at Basheer, continue as usual.

- However, due to bank closures, documentation cannot be approved by customs, reducing the number of ships berthing to unload cargo.

3- Maersk has filed a lawsuit against Evergreen over the 'Ever Given' Suez Canal blockage.

Maersk, the giant shipping company, has filed a complaint against Evergreen with the DynaMark's commercial Court. Maersk aims to get ($34m) for delays.

The controversy surrounding it is about the delay that happened by the blockage of the Suez Canal.

The claim is regarding the losses that losses suffered during the canal’s blockage. They will cover costs that incurred from customers’ goods that delayed ships.

3- Container shipping market outlook for 2023:

Although container spot freight prices increased at the beginning of the year, they are currently lower than the 10-year average, according to Drewry

After 43 straight declines, Drewry's composite World Container Index (WCI) increased 0.7% in the week ending January 5, 2023.

The WCI has decreased 79% from a peak of $10,377 each feud in September 2021 to its current level of $2,135 per feud. The index is currently less than the $2,694 per feud 10-year average, which according to Drewry indicates a return to normal prices.

4- Quick Hint of the IMO 2023 Regulation

The International Maritime Organization (IMO) Greenhouse Gas Strategy (GHG) intends to cut carbon emissions from international shipping by 40% by 2030 and 70% by 2050

compared to 2008 levels.

Both commercial and non-commercial vessels are impacted by the IMO 2023 regulation.

It introduces obligatory reductions in carbon emissions for both new and existing ships, utilizing energy efficiency indicators to calculate these limits. The following are some of the measures:

- The Energy Efficiency Exciting Ship Index (EEXI)

- The rating system for the Carbon Intensity Indicator (CII)

Packaging Industry in 2023

Are you wondering why we have divided packaging development into 3 eras? The answer is that we noticed that since 2020, there have been 3 critical changes happened to the packaging industry. First, we have to demonstrate the reasons for these changes:

- The first reason for this change is that the packaging industry depends mainly on the customers’ behaviors. In this ever-changing life, customers are always searching for new packaging products and new innovations to satisfy their needs.

- The second one is the digital transformation in our daily lives. Social media and mobile devices sped up the development of the packaging industry.

- In addition to those reasons, there is a significant shift to the online shopping that increase the plastic waste. Proceeding from this situation, consumers are searching for sustainable packaging solutions.

The 3 plastic packaging eras in detail:

“The flexible packaging Era” (from 2000 to 2009)

In this period, consumers behaviors change, they need to use flexible packaging items, small handy packs.

That’s why the packaging manufacturers aim to keep up with the new needs. They shift from rigid packaging such as glass and metal to plastic. They manufacture lightweight and small packs with less material.

“The Recyclability & Awareness Era” (from 2010 to 2020)

The financial crisis that the world faced, combined with the pandemic. Consumers start to realize the problem of packaging leakage and its effect on the environment. They become aware of how to depend on online shopping during covid-19 crisis. This era also witnessed an increase in health awareness; the consumers became much more dependent on fresh and healthy goods.

The packaging industry kept up with this evolution. The manufacturers and brand owners increase their usage of recycled materials. They come back to the non-plastic packaging such as paper. It is worth mentioning that plastic was still their first choice as they didn’t find functional and cost-effective alternatives.

“The Digitalization Era“ (from 2020 till now)

In the current era, social media and E-commerce have become the main engines for consumers. That’s why brand owners try to satisfy consumers by providing sustainable solutions. The packaging is adapted to e-commerce standards. Brand owners try to keep pace with the innovative technologies like (refill & reuse) technology with sustainable packaging materials. Worth mentioning that there will be a continuous development in the packaging industry in the next decades as a response to the higher production of the new plastic compounds.

Your FAQS about packaging solutions

1. How to bond or seal uneven surfaces?

Depending on your application, we have 2 options to choose from to solve this problem:

- The first is the double-sided foam tape; it is a thick tape that can help you in bonding uneven surfaces. You have to choose a good type of tape that can withstand high levels of impact and vibration. This tape can be a workable solution for many applications such as plastic fabrication.

- The second option is the single-sided foam tape that you can use to fill gaps and seal. It will be perfect for plastic insulation applications.

2. How to solve the highness of injection molding temperature?

First, we have to divide the thermoplastics into 2 types; Good fluidity such as PP, PE and PS & Poor fluidity such as hard PVC (Poly Vinyl Chloride) and PC (Polycarbonate). The high temperature increases the flow of the raw material. This will affect the impact resistance of some materials such as PS (Polystyrene).

3. What is the solution for air bubbles in injection molding parts?

When you find bubbles in injection molding products, you must solve this problem immediately. If you identify the reason, you will solve it. Let us dig deeper into this problem reasons:

If the reason is in the drying process of the plastic raw material, you can solve it by paying attention to the hopper insulation management.

The reason may be the melt temperature setting of the injection mold. You have to consider that holding pressure and the injection pressure are not enough.

4. What to do to solve the injection molding wall thickness problem?

If you face this problem during injection molding process, you can simply solve it. The first solution is noticing the areas that have the problem then you can find 2 issues; the first one is the thickness around screw holes and thickness in the parts that need more strength.

If the problem comes from the screw holes in the molding parts, you can use “screw bosses” which is a small cylinder of the material that can be put around the screw holes, you can tie it to the rest of the housing. This method can help you to uniform wall thickness.

When it comes to the strength of specific part while the wall is too thick, the ribbing is the best solution. First try to thin the exterior face and turn it into a shell, then you can add the ribs of the material to the interior. This can help you to increase the rigidity and the strength of this part. With this solution you can reduce costs.

5. What causes voids in the injection molding parts and how to solve it?

“Voids” presents the air pockets that appear in the molding parts in both transparent and colored applications. This defect occurs when the internal layer takes more time to cool than the outside layer.

Here are 3 options you could try to solve this problem:

- The first suggestion is to choose one of these solutions: increasing the shot volume, increasing the screw forward time, reducing the melt temperature, and adjusting the speed of the injection.

- The second solution is related to mold, here you must ask yourself some questions. Is the gate in the correct position? Is the mold temperature too low? Are you using the perfect gate size?

- The material could be the reason, you can check the material if it is affected by the excessive moisture.

Latest Trends in the Food Packaging Industry

The global food packaging market is expected to reach $478.18 billion in 2028 at a CAGR of 5.1% in the period between 2021 & 2028.

Preventing food related diseases, preserving food quality, Prolonging the products’ shelf life. All these and more are the purposes of food packaging. And now with the ever-changing lifestyles, the need to packaging trends with plastic material becomes more crucial. Let’s see how:

Consumers are permanently searching for packaging innovations which perfectly matches the plastic industry and polymers.

For instance, PP (Polypropylene) is used to produce creative food packaging trends. Current trend in 2022 is creating attractive labels from plastic resins. Worth mentioning that Sabic produced first PP packaging labels from ocean-bound plastic.

Recycled plastics such as recycled PET and HDPE will see growing demand. Sustainable packaging is the trend of the year because of the climate change.

When it comes to the global food packaging market by application, study in 2020 approved that the fruits and vegetables packaging took the first place, then the bakery and dairy products.

There is a new creative packaging equipment every day, so the need for LDPE shrink films, PVC wrappers will increase. The plastic industry will continue to provide solution to satisfy all customers’ needs and expectations in packaging.

The future of GAP Polymers (Global Advanced Polymers) In 2023

The future is already here in GAP polymers, as we aim to sell 1 million tons of polymer material globally by 2030 while being the top distributor in Africa.

We try our hardest to build strong strategy by delivering unique value to our customers. “We put ourselves in our customers’ shoes”, that’s why we are not only offering customer after-sales service but also technical service to ensure that our clients are perfectly dealing with our raw materials.

Expansion

We have been successfully developing our 6 branches, and in 2023 we are expanding in new plastic markets such as North Africa.

New products

We are also looking forward to supplying our customers with new products such as recycled plastic.

Customers’ relationship

“GAP Polymers” also wants to enhance the relationship with our customers to be a long-lasting relationship by laying our valuable fundamentals such as integrity in business, providing quality in the supply process, flexibility, teamwork to ensure that our customers are highly satisfied.

We hope that our brief newsletter has given you economic indicators to anticipate how the polymer industry will deal with global crises such as the pandemic. How war will affect the prices of the products.

Subscribe to see the future and gain a competitive edge. Subscribe from Here!

Suggested Blogs

Exclusive vs. Non-exclusive Distributor

GAP Polymers Team

Have you ever wanted to know the difference between the exclusive and the non-exclusive polymer distributers, GAP polymers will help you to know the main differences between them.

An Overview of Polypropylene Thermoforming Process

GAP Polymers Team

PP is the second most popular plastic resin in the world used across many industries. Thermoforming PP has become a process of choice for many manufactures due to its versatility low cost , and more.

Weekly Plastic News & Resins Pricing

GAP Polymers Team

A weekly coverage of all you need to know about the international plastic industry including resin pricing, trends, market insights, and more.

A Deeper Look Into Plastic Manufacturing Industry

GAP Polymers Team

Keep up with the rapid changes of the plastic manufacturing industry and dive deep into what shapes the polymer industry and how to choose the best raw material supplier for your business.

Top Plastic Raw Material Suppliers

GAP Polymers Team

The polymer industry is facing continues challenges and choosing the best supplier is getting harder. Look no further and explore the full list of the top plastic raw material suppliers.

5 Polymers Used in the Automotive Industry

GAP Polymers Team

Plastics industry has changed the method of manufacturing cars. Now you can explore which material are used in automobiles and how automotive plastics affects demand in the polymer industry.