Petchem industry positioned for digital transforma...

The energy industry is lagging other sectors on the race to adopt digital technology, but increases in capital investment are pushing digital transformation now more than ever, industry analysts told Petrochemical Update.

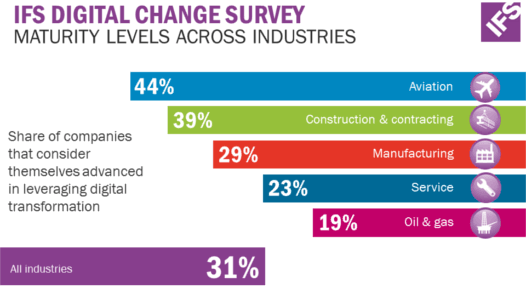

IFS, a global enterprise applications company, recently conducted a Digital Change Survey that polled 750 decision makers in 16 countries to assess maturity of digital transformation in sectors such as manufacturing, oil and gas, aviation, construction and contracting, and service. The oil and gas industry, which includes the downstream petrochemical sector, was at the bottom of the list.

“It is apparent that companies today understand the urgency of focusing on digital transformation.” IFS Vice President of global industry solutions Antony Bourne said. “Technologies such as big data and analytics, enterprise resource planning and internet of things are paramount to transforming a business.

Big players leading the technology shift including Uber, Twitter, Amazon, AirBnB, LinkedIn, Facebook, Snapchat, Google and more have found success by understanding and pushing digital disruption technology including the use of data powered analytics, cloud computing, automation, asset visualization, mobility, and social media.

Capital investment

Given the industry’s substantial increases in capital investment, optimizing production efficiency using digitization is essential, according to McKinsey & Company.

The costs savings to optimizing production through digital transformation are so substantial that McKinsey & Company estimate that improving production efficiency by 10 percentage points can yield up to $220 million to $260 million bottom-line impact on a single asset.

The American Chemistry Council (ACC) estimates there are 310 projects currently under construction or planned and $185 billion in potential capital investment as of mid-year 2017, up from the 97 projects and $72 billion in March 2013.

There are 474 active upstream projects worth $213 billion in the U.S. and Canada, and another 723 active refining-related projects worth $80.5 billion in North America, according to Industrial Info. “Executives need to have an intimate knowledge about the digitization and how it will transform their business, rather they want it or not,” said Trond Ellefsen, Special Advisor Digital Transformation and Strategy at Statoil. Ellefsen was speaking on an Upstream Intelligence webinar. “This is where we are headed. This is not just a technology journey. This is foremost a cultural change toward something completely different than what it is today. The world will look completely different to the oil and gas industry in five to seven years,” Ellefsen said. From manual to digital Wildly successful technology companies including Uber and social media sites like Twitter and Facebook have found success over the last decade and changed consumer behavior even by implementing digital transformation programs and making them part of their overall strategy. But the petrochemical and oil sectors fell behind as the industry wrestled with volatile oil prices, decreases in productivity and changing labor demographics, and could benefit strongly from implementing a digital transformation program, according to industry executives. Digital transformation at its core allows organizations to tackle disruptive changes such as marketplace fluctuation by designing new products, services, and business models leveraging digitalization. So changes in production, oil prices and investment are the perfect time to dive in, anaylsts explained. “Up until 2008-2010 timeframe, it was adequate to say that incremental baby steps were sufficient to go forward,” Ellefsen said. “Now because of the crash in the oil price, we have been left behind by the rest of the industry even more.” The oil and petrochemical industry has for years relied on manual processes for things such as equipment installation, repairs, logistics, maintenance, waste disposal. The problems make their way all the way to distribution where terminals are running 20-30-year-old software and running paper bill of ladens. Customers end up with accuracy issues and confusion over deliveries. “The next generation of really successful companies will be those that manifest their intellectual property in digital form and take advantage of the transformation opportunities that exist for them,” said David Holmes, CTO Energy for DellEMC. A different digital approach “If you look at Uber, Facebook, LinkedIn, AirBnB, etc, these are technology platforms where the customer creates, consumes and shares the information and the ability to connect from any device anywhere is the actual technology shift going on,” said Terry Price, Industry and Technology Thought Leader at IBM. The energy industry is different in that the information is created and maintained by the operator and most often kept in silos, often unused. Therefore, in the case of oil, gas and petrochemicals, the customer is not interacting with the information or working with the supply chain in the same way disruptive technology does. “What we are finding is that the executive is driving digital transformation and in many cases, this is based on improvements in disruptive technology,” Price said. “Then this directive is pushed down to the business where people are trying to align the new ways of thinking to traditional programs and thinking.” In practice Some companies in the energy industry have taken incremental steps to push digital transformation while others have a huge executive led initiative. Leading EPC firm Bechtel has created a data analytics team, hiring data scientists to mine the company's growing datasets. Data analytics, along with the deployment of the latest handheld devices and 4D and 5D modelling, has improved decision-making in areas such as piping productivity and staff logistics, Joe Thompson, Senior Vice President, General Manager – Downstream & Chemicals, Bechtel Oil, Gas & Chemicals said.. Microsoft and Halliburton are entering into a strategic alliance to drive digital transformation across the oil and gas industry. The relationship will combine Microsoft's expertise in cloud and digital transformation with Halliburton's exploration and production (E&P) science, software and services. Oil price factor Volatile oil prices may have hindered investment previously, but are motivating the industry to get moving on digital technology now, according to analysts. “Just a few years ago when oil prices fell off the cliff, most people were just praying for prices to come up rather than taking a real stand on digitization or changing the foundational elements of their business,” Ellefsen said.

“While some companies are still praying for oil prices to return, other companies are taking a different approach. They are looking at technological capabilities that we did not have just a few years ago. These can bring tremendous value,” Ellefsen added. “The industry can no longer disregard the reality that we are going toward a digital world,” he added.

By Heather Doyle

Suggested Blogs

Exclusive vs. Non-exclusive Distributor

GAP Polymers Team

Have you ever wanted to know the difference between the exclusive and the non-exclusive polymer distributers, GAP polymers will help you to know the main differences between them.

An Overview of Polypropylene Thermoforming Process

GAP Polymers Team

PP is the second most popular plastic resin in the world used across many industries. Thermoforming PP has become a process of choice for many manufactures due to its versatility low cost , and more.

Weekly Plastic News & Resins Pricing

GAP Polymers Team

A weekly coverage of all you need to know about the international plastic industry including resin pricing, trends, market insights, and more.

A Deeper Look Into Plastic Manufacturing Industry

GAP Polymers Team

Keep up with the rapid changes of the plastic manufacturing industry and dive deep into what shapes the polymer industry and how to choose the best raw material supplier for your business.

Polymer Industry Updates: What's coming up in 2023?

GAP Polymers Team

2023 is a critical year in the polymer industry at all levels. Global polymers market size is expected to grow finally after the economic recovery from the pandemic.

Top Plastic Raw Material Suppliers

GAP Polymers Team

The polymer industry is facing continues challenges and choosing the best supplier is getting harder. Look no further and explore the full list of the top plastic raw material suppliers.